Waco car title loans appear as quick cash solutions but carry significant risks. These secured loans expose borrowers to repossession if repayments fail, while aggressive sales tactics, high-interest rates, and hidden fees contribute to debt traps. To avoid these pitfalls, prioritize long-term financial stability, exercise caution, verify lender legitimacy, compare rates, and explore alternative relief options for better terms and transparency.

In Waco, TX, understanding the risks associated with car title loans is crucial to avoid falling victim to predatory lenders. This article guides you through the intricate landscape of Waco car title loans, highlighting red flags and predatory practices. We empower you with knowledge by offering insights into what to look for and providing best practices & alternative options to protect yourself financially. By understanding these aspects of Waco car title loans, you can make informed decisions and steer clear of exploitative lenders.

- Understanding Waco Car Title Loans: Risks & Red Flags

- Spotting Predatory Practices: What to Look For

- Protecting Yourself: Best Practices & Alternative Options

Understanding Waco Car Title Loans: Risks & Red Flags

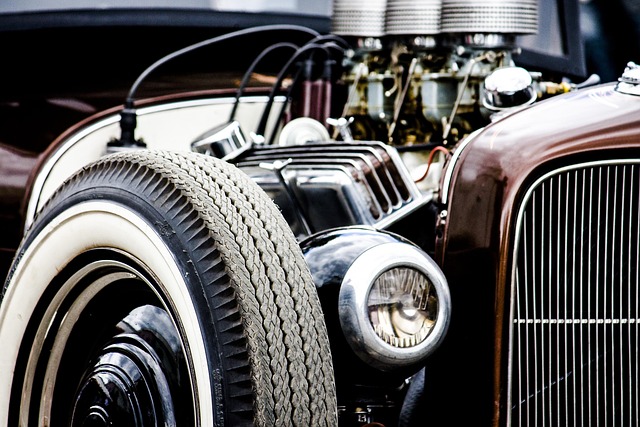

Waco car title loans can seem like an attractive option for those in need of quick cash. However, it’s essential to understand that this type of loan involves significant risks and potential red flags. These loans are secured by your vehicle, which means if you fail to repay the loan as agreed, the lender has the right to repossess your car. This can leave you without transportation, a critical component for many people in Waco who rely on their vehicles for work or daily routines.

Before considering a Waco car title loan, be wary of aggressive sales tactics and high-interest rates. Lenders offering loans with seemingly low monthly payments but exceptionally high annual percentages (APRs) are often predatory. Additionally, keep an eye out for hidden fees and penalties for late payments. Remember that while these loans can provide a cash advance in the short term, they can quickly spiral into debt if not managed carefully. Always prioritize keeping your vehicle and focus on long-term financial solutions rather than short-term relief.

Spotting Predatory Practices: What to Look For

When it comes to spotting predatory practices in Waco car title loans, knowledge is your best defense. Predatory lenders often target individuals with limited financial options or poor credit history, preying on their desperation for quick cash. They may use aggressive sales tactics and offer seemingly appealing terms that mask hidden fees and sky-high interest rates. Look out for these red flags: unusually short repayment periods, excessive fees that significantly increase the total cost of borrowing, and pressure to sign documents without thorough explanation.

Some lenders might also encourage you to put up your vehicle as collateral, which can make it easier for them to repossess it if you default on payments. Others may suggest a title transfer or loan refinancing as a way to get out of debt, but these strategies could cost you more money and extend the term of your loan. Always read the fine print, understand all charges, and compare rates from multiple lenders before making any decisions regarding Waco car title loans.

Protecting Yourself: Best Practices & Alternative Options

Protecting yourself from predatory lenders starts with understanding their tactics. In Waco, TX, where car title loans are popular, it’s important to remember that these short-term loans often come with sky-high interest rates and harsh terms. Before agreeing to any loan, verify the lender is licensed and regulated by the Texas Office of Credit Regulation.

Consider alternative options for debt relief instead of a quick approval or same day funding promise. Consolidating debt through traditional loans from banks or credit unions can offer better interest rates and repayment terms. This ensures you aren’t trapped in a cycle of high-interest payments that can make your debt worse, as is often the case with Waco car title loans. Prioritize transparency, fairness, and long-term financial stability when exploring any lending option.

When navigating the financial landscape in Waco, understanding the potential risks associated with Waco car title loans is key. By recognizing red flags and adopting best practices, you can protect yourself from predatory lenders. Remember, informed decisions are crucial in avoiding a cycle of debt. Consider exploring alternative options to Waco car title loans, such as building credit or seeking assistance from local community resources, to secure more favorable terms and avoid potential financial pitfalls.