Waco car title loans have emerged as a vital financial safety net for residents facing urgent economic needs, offering swift approvals and accessible funds. With diverse financial obligations in dynamic Waco, these secured loans help individuals manage unexpected costs, attracting borrowers seeking flexible financing options outside traditional bank loans. Rising living costs prompt households to leverage vehicle ownership for quick cash, empowering them to navigate challenges with enhanced flexibility.

Waco, a vibrant city with a unique economic landscape, offers insights into how local financial trends shape access to capital. This article explores the role of Waco car title loans as a reflection of the community’s economic needs and preferences. By examining recent trends, we uncover how these short-term loan solutions cater to residents’ financial demands, especially in times of economic shifts. Understanding these patterns provides valuable context for gauging the health of Waco’s financial ecosystem.

- Waco Car Title Loans: Understanding Local Financial Demands

- Economic Trends Shaping Loan Preferences in Waco

- The Role of Waco Car Title Loans in Supporting Community Finance

Waco Car Title Loans: Understanding Local Financial Demands

Waco car title loans have emerged as a significant financial tool for many residents facing immediate economic challenges. This type of secured lending offers quick approval and accessible funds, catering to those in need of emergency money. In the bustling city of Waco, where financial demands vary widely, these loans provide a safety net for individuals and families dealing with unforeseen expenses.

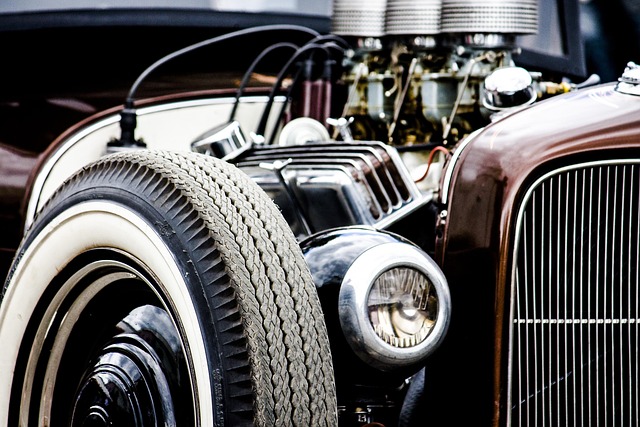

The local market’s demand for Waco car title loans highlights the importance of flexible financing options. With many residents relying on them for unexpected costs, these loans offer an attractive solution. A key advantage is the loan payoff structure, allowing borrowers to regain control of their finances once they have met the agreed-upon repayment terms. This option proves invaluable when managing financial strain and ensuring stability.

Economic Trends Shaping Loan Preferences in Waco

Economic trends significantly shape the preferences and behaviors of loan seekers in Waco. With a growing population and a diverse job market, residents often turn to innovative financing options like Waco car title loans to meet their short-term financial needs. The region’s economic landscape, characterized by a mix of industries including healthcare, education, and technology, contributes to varying income levels and financial priorities among its citizens.

As a result, the demand for flexible and accessible loan solutions, such as Waco car title loans, has been increasing. These loans cater to individuals who may have limited credit options or need quick cash for unexpected expenses. The title transfer process is designed to be straightforward and efficient, reflecting the modern approach to financial services. Furthermore, with rising living costs and inflation, many households in Waco are seeking alternatives to traditional bank loans, where interest rates can be stringent, to secure funds for essential purchases or to manage cash flow gaps.

The Role of Waco Car Title Loans in Supporting Community Finance

In the vibrant city of Waco, Texas, access to immediate financial support is crucial for many residents, especially when unexpected expenses arise. Here, Waco car title loans have emerged as a significant tool in community finance. This alternative lending option allows individuals with collateralized vehicle ownership to secure rapid loan approvals without traditional credit checks. By utilizing the title transfer process, lenders in Waco offer a streamlined and accessible way for borrowers to gain financial relief during challenging times.

These loans cater to those who might be excluded from conventional banking systems or require quick cash for various purposes, such as medical emergencies, home repairs, or business investments. With Fort Worth loans being readily available, the community benefits from enhanced financial flexibility, enabling individuals to manage their affairs with confidence and potentially avoid falling into debt traps offered by less reputable sources.

Waco car title loans have emerged as a significant tool for meeting the economic needs of the local community. By understanding the trends shaping loan preferences, we can appreciate how these short-term financing options play a crucial role in supporting residents during challenging financial times. As economic conditions fluctuate, Waco car title loans remain a vital resource for those seeking quick access to capital, demonstrating their importance in the broader landscape of community finance.