Waco car title loans are regulated by state laws aimed at protecting borrowers, ensuring fair practices like precise vehicle valuation, clear terms, upfront fee disclosure, and the right to cancel without penalty. These laws allow borrowers to keep their vehicles during repayment, limit interest rates, and provide safeguards against predatory lending, fostering a positive lending experience.

In the competitive world of lending, understanding local laws is crucial, especially when considering a Waco car title loan. This article provides an essential overview for borrowers navigating the complexities of Waco lending laws. We explore key protections offered to borrowers under these regulations, focusing on Waco car title loans. By understanding your rights and responsibilities, you can make informed decisions while ensuring compliance with local guidelines.

- Understanding Waco Lending Laws: A Overview for Borrowers

- Key Protections for Car Title Loans in Waco

- Your Rights and Responsibilities: Navigating Waco Car Title Loans

Understanding Waco Lending Laws: A Overview for Borrowers

Understanding Waco Lending Laws: A Borrower’s Guide

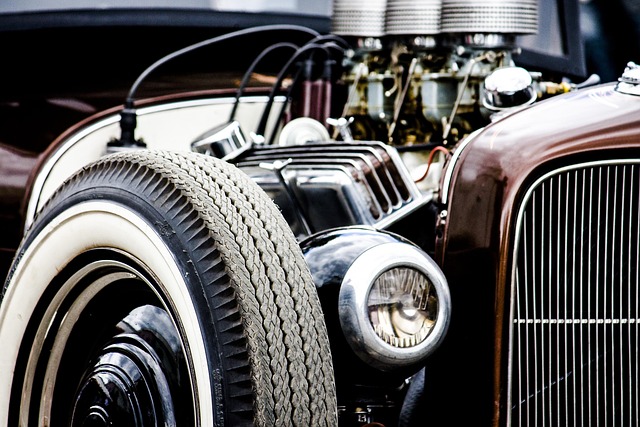

Waco lending laws are designed to protect borrowers and ensure fair practices in the financial sector, especially when it comes to Waco car title loans. These laws provide a framework that lenders must follow, ensuring transparency and preventing predatory lending. One of the key aspects is the requirement for lenders to conduct thorough vehicle valuation before offering any loan, ensuring that the collateral is worth the amount borrowed. This protects borrowers from taking on more debt than their vehicle is worth.

Additionally, Waco car title loans are secured by the borrower’s vehicle, serving as collateral. This means if the borrower fails to repay the loan according to the agreed-upon terms, the lender has the right to repossess the vehicle. Borrowers should be aware of this process and understand their obligations to maintain ownership of their collateral until the debt is settled. Understanding these laws empowers borrowers to make informed decisions, ensuring they access lending services that align with their best interests.

Key Protections for Car Title Loans in Waco

In Waco, borrowers seeking car title loans are protected by state laws designed to ensure fair and transparent lending practices. Key protections include clear and concise loan terms, upfront disclosure of all fees and interest rates, and the right to cancel the loan within a specified period without penalty. These measures are in place to prevent predatory lending and ensure that borrowers fully understand their financial obligations.

Additionally, lenders in Waco must adhere to strict guidelines regarding the repossession of vehicles used as collateral for car title loans. Borrowers have the right to challenge repossession if they believe it was unjust or premature. This safeguard provides an extra layer of protection, ensuring that both parties involved in a Waco car title loan transaction are treated fairly and equitably.

Your Rights and Responsibilities: Navigating Waco Car Title Loans

When considering a Waco car title loan, understanding your rights and responsibilities is crucial. These loans, secured against the title of your vehicle, offer access to immediate funds. However, lenders in Waco are subject to state regulations designed to protect borrowers. One significant advantage for Waco residents is the ability to Keep Your Vehicle during repayment, unlike traditional payday loans.

This security provides a safety net, ensuring you retain possession of your car while repaying the loan. Moreover, Texas law caps interest rates and fees on these secured loans, known as semi-truck loans or title loans, offering relief from predatory practices. Borrowers should review their contract thoroughly to comprehend repayment terms, including due dates and any associated penalties, to ensure a smooth lending experience.

When exploring Waco car title loans, understanding your rights and the applicable borrower protections is paramount. This article has provided an overview of Waco lending laws and highlighted key protections specific to car title loans in the region. By familiarizing yourself with these rights and responsibilities, you can make informed decisions when borrowing, ensuring a fair and transparent process. Remember, knowledge is power, especially when it comes to financial transactions like Waco car title loans.